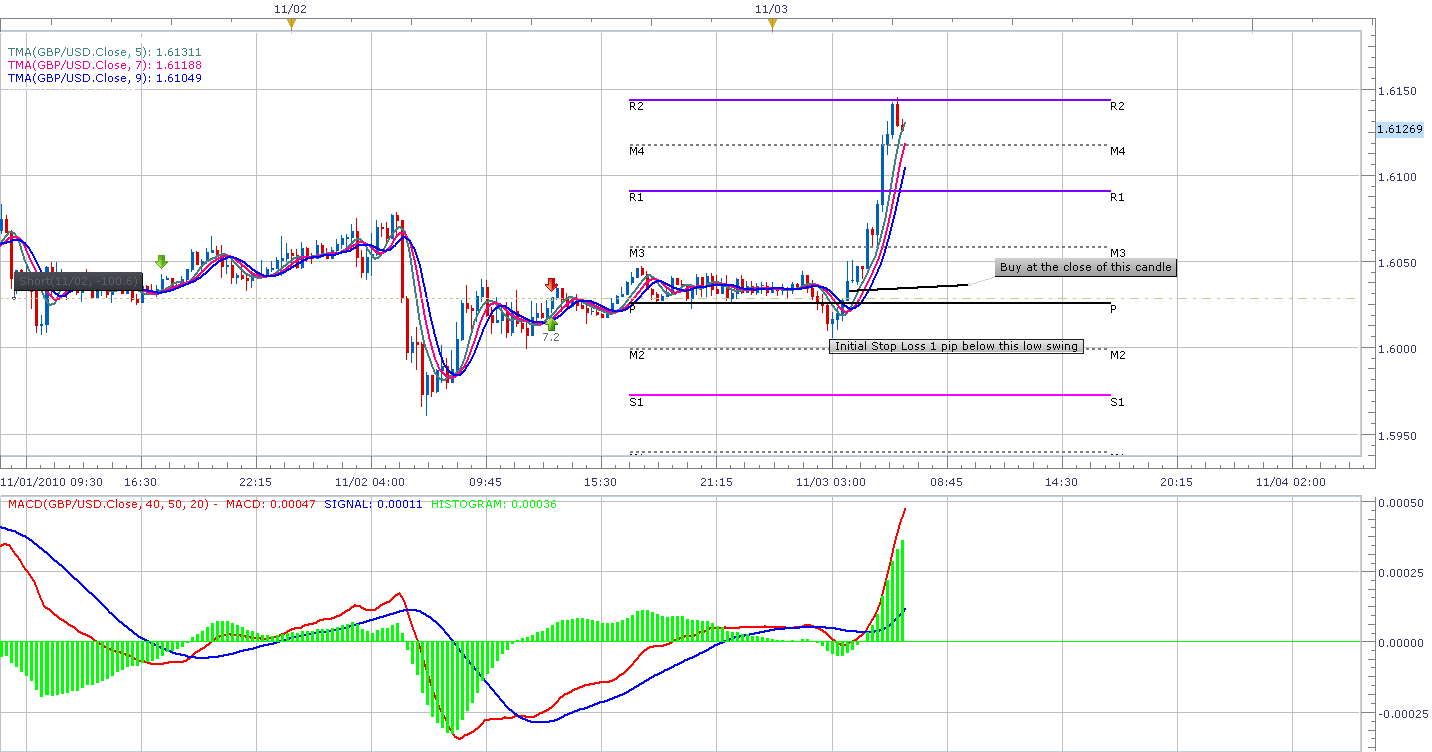

Forex Money Management*Losing is part of every trader's life. Focus on keeping your losses small and you will join the group of winning trader. What Is Forex Money Management?Forex Money Management is the most important piece of the puzzle in forex trading. If your desire is to become a successful forex trader, then give a great deal of your time in studying forex money management rules. Forex money management is the act of managing your losses and keeping them small, while maximizing your winning trades. On this page, you will learn how to effectively manage your trades. The risk management rules mentioned here are simple enough. Please do yourself a favor and follow the rules. If you don't, you will only be a forex trader for a short time. The risk of trading without forex money management rules in place are enormous. Importance Of Forex Money Management?Forex money management skill is what makes the difference between winning traders and losing traders. Winning forex traders have developed the ability to take very small losses and maximize profits while losing traders have not mastered the ability to take small losses. Losing traders allow losses to grow until they become paralyzed by the bigness of the losses that they can't take any action, but hope that the market reverses. Whenever I have done this, I have experienced margin call. I am saying this out of experience. I did this before. Lost a lot. But when I determined that I will follow my system just as it is, with the forex money management rules, I began realizing profits without much work. So the importance of forex money management is to help you become a profitable trader. With out risk management, you will lose and eventually get out of the trading game. So take this serious.Forex Money Management RuleThe simple forex money management rule for my forex trading system is initial stop loss. What is initial stop loss? Initial stop is a price at which you will cut your losses and close your trade if the trade goes against you. This is very important. Without initial stop loss whenever you take a trade, you are at the mercy of the market. Here are the rules I use to place my initial stops. When a buy signal occur, I take my trade and then place my initial stop loss 1 pip below the immediate swing low candle. This price point is always clear when a trade signal occurs. It is that simple. Don't allow the fear of loss to keep you from placing initial stops. I have done it a couple of times and it is not fun, when disaster strike and the market sudden goes against the trade. Don't do it. Always place this initial stop. It will save you a lot of money. See the chart below for an example of buy entry point and an initial stop loss Click here for clearer picture

*Important tip: Charts don't lie. If we trade what we see on the charts, we should be fine. If we take care of the losses, the wins will come. So focus on keeping losses small. Forex Money Management Multiple TradesThis is a sell setup. Look at the chart below in the setup. This is a 15 minute chart, but you can easily apply this to any time frame. The first trade resulted to 4pips. You may asked, why close the trade when it is still going in the same direction? That is a good questions. Well, you don't know where the market is going to go, period. No one does. So in exiting a trade when an exit signal occurs is your safe bed. You can always re-enter as I did in this case. Remember, there will always be the next trade. A second sell signal occured and a trade was taken. The second trade resulted to 53 pips. Once you take the second trade, the initial stop would be at the immediate swing high. If you just stick to this rule, you will do just find with your trades. In a 15 minute chart, this trades can occur over and over again. Just stay focus on what you are doing. See the chart below for an example initial stop loss on multiple sell trades. Click here for clearer picture

*Important tip: Profits in forex trading do take care of themselves. All you have to do is focus on losing like a pro. Profitable traders always adhere to their initial stops. If you want to last in this trading profession,then adhere to your initial stops. They will save you a ton of money and above all you will become a successful trader. Forex Money Management Plan -LeverageLeverage in forex trading is a double-edged sword. It can help you drastically increase your profits. However, it can also drastically increase your losses, if you don't manage your trades very well. If you really want to last long enough as a forex trader, then I would advice you now to employ lower leverage when you trade. If you use high leverage, you risk losing substantial amount of your trading capital. I have done this and yes I lost the trade and lost a lot of money. Don't take my word for it, try it.What is leverage and how does it relate to forex money management?To explain what leverage is and how it relates to money management, let's look at this trading example between two traders. Call them Trader Y and Trader Z Trader Y buys 250 1k lots of EUR/USD while Trader Z buys 25 1k lots of EUR/USD. Let's price of EUR/USD falls 100 pips against the traders. Look at what happened to equity in both accounts.Trader Y and Trader Z all starts with a balance of $5000 Trader Y buys 250 1k lots of Eur/Usd for a trading size of $250,000 Trader Z buys 50 1k lots of Eur/Usd for a trading size of $25,000 If Trader Y and Trader Z continue to employ the amount of leverage as they did in their last trade, which trader do you think will last long as a forex trader? The answer is pretty straight forward. Trader Z is managing his account equity very well. Though he has the ability to trade upto 400:1 leverage for other countries and a maximum of 50:1 for USA account holders, you don't have to employ these high leverages. They are simply a trap to new novice traders. I fell for it and lost big time. As you can see, by using a lower leverage trader Z reduces the dollar drawdown of a 100 pip loss. He can afford to trade another day. I still trade with a micro account. The leverage is enough for me to steadily grow my account month after month. There is mini account and standard account you can employ for your trading. For the different account types you can go to Forex Trading Account.

Forex Money Management: When in ProfitHow do you manage your trade once you are in profit? Depending on your trading style. I am a day trader. I trade on a 15 minute chart, which means I usually take my profit off the table within the same day. However, I trade sometimes on the 8 hour chart. These trades usually last about 2 to 3 days. Once you are in profit, strive to move your initial stop loss to break even. My broker's chart software gives the option of dynamic stop trailing or fixed trailing stop. For example, once I set my initial stop loss, I let the trade automatically trail the trade as it moves to my favor. The option of a fixed trailing stop is also available. When a trade is taken with an initial stop loss of say 20 pips, I enter a fixed trailing stop of 20 pips. That means every time the trade moves 20 pips, the stop will automatically be moved 20 pips. That way, you can follow your trade without sitting on your computer. So your risk on this trade is always 20 pips. When you return on your computer one of two things must have happened. The trade is still open, or its been closed, positive or negative. But because of your trade management, you know that the maximum risk of this trade has always been 20 pips. With this you can sleep in peace with open trades. This will only happen if you employ low leverage as mentioned above. Combine this strategy of trailing your profits with low leverage, you are guaranteed to grow your account steadily over time. Forex Money Management: When in LossesHow do you manage your trade when it goes against you? Your initial stop loss takes care of this aspect of your trade. Sometimes, I don't even allow it to get to the initial stop loss. If an opposite signal occurs and I am sitting on my machine watching the trade, I simple close the trade. That is it. No emotions involve. There will always be another trade. Learn to take small losses. I don't tolerate huge losses. I did before hoping the market would turn and the losses got so big that I was literally paralyzed and couldn't do anything until I had a margin call. I lost an account of $10000. So never allow the negative trade to paralyze you. Keep your initial stop loss in place. If you not courageous enough to close the trade because it is negative, just learn to keep your initial stop loss in place. It will take of you when catastrophe strike. Forex Money Management: ConclusionYou will hear people say, never risk a certain percentage of your account. Say 2% maximum. I prefer to just set my initial stop loss based on what I am seeing on the charts. If the initial stop loss is much more than what I can tolerate for any one trade, then I simply don't take the trade, or I patiently wait for a signal that gives me the right initial stop loss value to take the trade. On the 15 minute charts, I get about two opportunity a currency pair a day. So looking at the major currency pairs and a few crosses, you can have about 12 trades a day. You know what, the charts don't lie. YOu can place your initial stop loss, trade with low leverage and you can successfully manage your trades and gradually grow your account. If you know how much of your hard earned cash you are putting on the line every time you take a trade, you will confidently manage your trade. But if you don't use stop loss and leave your trade at the mercy of the markets, you simply are gambling and you will not last long. Forex Money Management is a skill that you need to master, before you can become successful as a forex trader. Now that you know how to identify simple entry points on your forex charts and how to manage your trades, its time to move forward and learn how to exit your trades like a pro. From forex money management that is trade management, you can now continue to Forex Exit Strategy If you came directly to this page from the search engines, then I encourage your to goto Forex Trading Tutorial. Get started with Trading Basics Menu. You will gain much by starting here. If you have read everything on the Forex Basics menu, then it is time to get the beaf of my trading system by heading to menu Forex Trading System

|

Accurate Forex Signals The forex signals provides Live Forex Signals. Razor-Sharp Short Term Signals. Ultra-Accurate Long Term Signals. Bob and Vladimir analyze the charts & predict market moves, then provide you with quality signals, all while mentoring

and educating you so that you can become a confident,self-empowered and successful forex trader. |